Welcome Avatar! Upon request from team BowTiedBull, BowTiedFellow here to provide you all with an update on the Stacks ecosystem. But first, a quick recap of how it all came to be:

We are hopefully familiar with Bitcoin and Ethereum by now. Ethereum is the brainchild of co founder Vitalik Buterin, a long-time Bitcoin bull. Vitalik envisioned a decentralized web that returned ownership to its users. This would prove difficult to build on Bitcoin because of the nature of Bitcoin, and so Vitalik and team proceeded to build a separate blockchain to serve as its foundation. Stacks is the brainchild of Muneeb Ali, who had a similar vision of a decentralized web. However, seeing Bitcoin as the ultimate source of truth, he proceeded to find a way to make Bitcoin programmable so it may serve as the foundation for the decentralized web. Two visionaries, two different blockchains.

Ethereum, launched in 2015, is a decentralized and open-source blockchain that serves as the primary innovator of Smart Contracts. Smart Contracts allow for the pioneering of decentralized applications (dApps) that remove the necessity of intermediaries present in services ranging from financial to gaming and social media. Ethereum is the second largest blockchain by token market cap (trailing only Bitcoin) and is home to many of the dApps we see today. It is currently undergoing a transition to Ethereum 2.0, where the mining mechanism will switch from Proof of Work to Proof of Stake.

Blockstack, launched in 2017, is the pioneer company that received SEC approval under Regulation A+ for an Initial Coin Offering (ICO) of the Stacks token (STX). Since Stacks2.0 mainnet launch in January 2021, STX is no longer considered a security under SEC regulations and STX may be traded freely. Stacks 2.0 is notoriously late to the Smart Contract game because of the holdup from the decision to go this route. But. Much of the dApps we see today are easily replicable on Stacks 2.0, where they are ultimately secured by the Bitcoin blockchain.

The remainder of this post will include an overview of the performance and growth of Stacks and trends within the ecosystem. To begin, a brief overview of Stacks (more thoroughly outlined in its whitepaper).

What is Stacks?

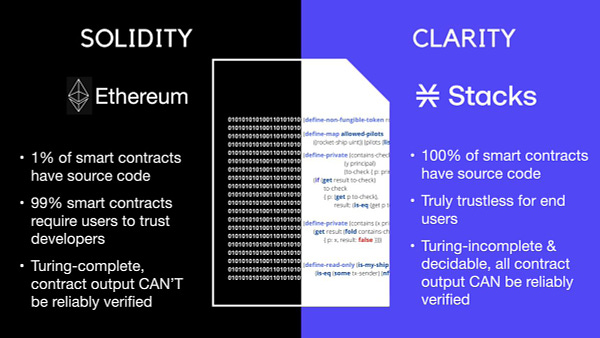

At its essence, Stacks brings dApps and Smart Contracts to Bitcoin. Bitcoin’s script is limited. Taproot may make Bitcoin’s script more efficient, but it still lacks the programmability necessary to write Smart Contracts. Creating Smart Contracts and dApps like you can on Ethereum requires a fully-expressive programming language. Ethereum uses a Turing-complete language called Solidity to write their Smart Contracts.

Contracts written on Solidity remain vulnerable to infinite or unbound loops that may yield outcomes unanticipated by developers and potentially exploited at the detriment of end users. Stacks uses its own fully-expressive programming language called Clarity that remains decidable and intentionally Turing-incomplete, so an individual may reliably analyze and verify all potential outputs on contracts written in Clarity.

Stacks 2.0 bootstraps itself to the Bitcoin through a mining mechanism called Proof of Transfer (PoX). The reason for doing so lies in the belief that Bitcoin is the most secure and scalable blockchain, and thus that’s what dApps and Smart Contracts (the decentralized web) should be built on top of. As a result of this mechanism, Stacks transactions are recorded on the Stacks blockchain and finalized on Bitcoin every Bitcoin block.

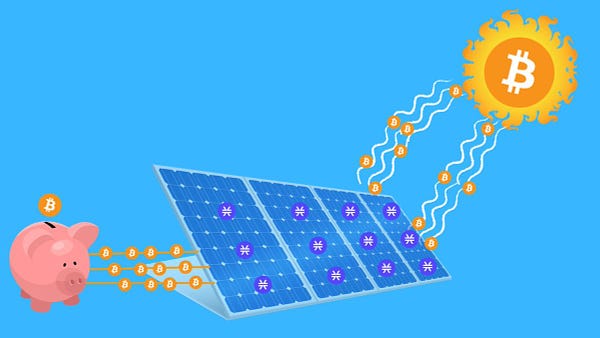

In Proof of Work (PoW - Bitcoin’s mining mechanism), energy is burned by BTC miners to compete for block rewards of BTC. In PoX, BTC is input by STX miners to compete for block rewards of STX (and STX from transactions). PoX is popularly referred to as recycled-PoW because the energy burned mining BTC is being reused via BTC to mine STX. Stackers are those on the opposite end of PoX who stack their STX and earn a distribution of the BTC mining proceeds at the end of every reward cycle. STX is popularly referred to as a BTC dividend token because of this distribution of BTC to stackers.

Quick note: much of the tokens in circulation today are a result of its ICO. The remainder of STX emissions follow a halving cycle similar to Bitcoin, but continue in perpetuity when block rewards yield 125 STX/block.

Performance, Speculation, and Growth

A belief I personally hold, stemming from the work of Charles Edwards and Capriole Investments, is that Bitcoin has an intrinsic energy value resulting from the cost of burning energy to produce BTC. The price correlation is not perfect due to the market effects of supply and demand, but it runs parallel to the price trend speculated by the stock-to-flow model. More on that here.

Due to this belief, I have a similar belief that Stacks itself may have an intrinsic Bitcoin value resulting from the committing and distributing of BTC to produce STX. I do not intend to prove a perfect correlation between the price movements of the two because of a) vast differences in market cap ($785B compared to $1.2B at time of writing); b) majority of STX being pre-sold in an ICO; c) the distribution of BTC to Stackers rather than burning; and d) market effects of supply and demand.

This is all to say that the prices of BTC and STX should generally move together. Strong energy prices and a healthy mining network should yield a strong BTC price, and vice versa. A strong STX price is derived of a strong Bitcoin price, among other things, and vice versa.

At the time of writing, BTC is worth around $41,314 and STX is worth around $1.15. Displayed below is a view of the STX/BTC trading pair in a 1W time frame: as seen on Binance

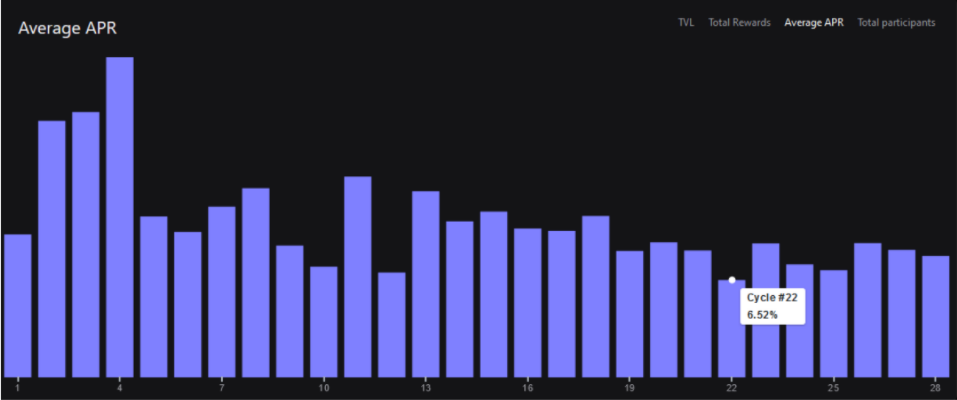

When estimating STX returns compared to BTC, one should consider BTC distributions resulting from stacking STX. This, along with price appreciation of STX, should also serve as a performance benchmark when analyzing for good investment decisions within the Stacks ecosystem. The average yield in terms of apy per Stacking Cycle is displayed below: as seen on stacking.club

Upon inception, the average apy in BTC from stacking STX has never dipped below 6.5%, as seen here. This is well above what would be considered by Wall Street a sustainable dividend yield. In fact, this juicy yield may very well encourage an increase in stacking interest, resulting in a dilution of individual returns. However. The capabilities and growth of the network, combined with the proven digital scarcity of STX and its BTC input, could result in a potential increase in mining interest that contributes to maintaining or exceeding this current yield, regardless of an increase in stacking interest. Let’s see what I mean:

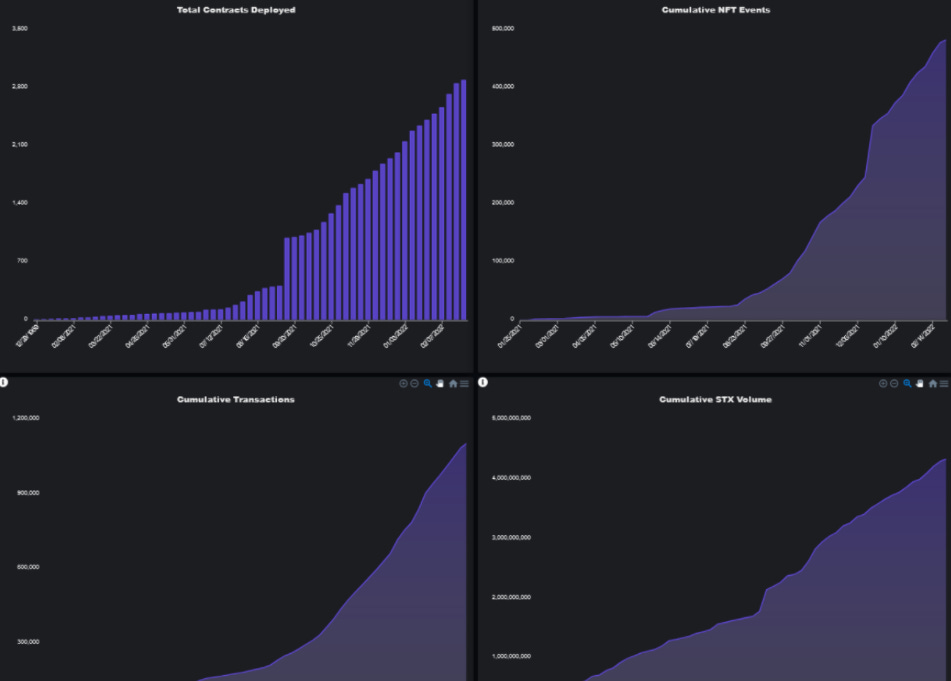

StacksOnChain is a Stacks analytics website pioneered by Jungle fren, BowTiedArcticWolf. Its primary use is analyzing the Stacks NFT market, as well as creating dashboards and running queries on the network and specific contracts. A useful query for simply viewing the growth of Stacks is outlined in the State of the Network, with a screenshot highlighting the major growth trends: aggressively up and to the right

In addition to the exponential growth of contracts deployed, NFT events, volume, and cumulative transactions, the network is also growing exponentially in users and developers. At time of writing, the amount of non-zero addresses (wallet addresses holding greater than 0 STX) is at 54,700. Programs, such as the Grants Ambassador Program, offer grants for individuals with a technical, design, or community background who commit their time to helping grow the ecosystem. Other programs, such as the Stacks Accelerator, aid tremendously in bootstrapping Clarity developers with the funds and expertise needed for a successful launch. A screenshot in a tweet from Muneeb features a report by Electric Capital that outlines Stacks as the only Bitcoin-focused web3 project with a growth in estimated monthly developers:

While the future is still undetermined, this growth should only continue because of the very nature of Stacks. Getting started in Stacks is as simple as acquiring STX off CoinBase or other exchanges and downloaded the Hiro web extension (the Stacks equivalent of MetaMask). The average transaction fee, currently at 0.365 STX ($0.41) is much cheaper than those found on other SC-enabled blockchains. The simplicity of Clarity removes the barrier of entry for many new developers and its decidability results in a reduction in time spent writing code. All of this, coupled with the fact that Stacks is secured by Bitcoin, presents a very bullish case for the growth of the network, and hopefully also, the price of STX.

It is worth mentioning that the Stacks network will regularly experience congestion due to the launch of popular projects. This, along with other areas for improvement and their potential solutions, are outlined clearly in this forum post by Muneeb. On the horizon, Muneeb forecasts a Stacks 2.1 update in the near-term that could improve the stacking experience, such as incorporating continuous stacking (avoiding missing reward cycles). Subnets and App-chains may present themselves as very promising scaling solutions in the medium-term to speed up transactions while keeping transaction fees low. If you are interested in learning more about this, I recommend checking out that forum post.

Trends in the Ecosystem

The explosive growth of the Stacks ecosystem is resulting in a wide variety of different projects and activities that STX holders may participate in. Because of Clarity, the creation of open source and verifiable contracts for functions and fungible/non-fungible tokens may simply be written and deployed, just like on other SC-enabled blockchains.

Proof of Transfer Lite

PoX is unique to Stacks and the concept may be endlessly replicated on other fungible tokens created in the ecosystem through utilization of Proof of Transfer Lite (PoX-L). One such project doing so is CityCoin, brainchild of the great Patrick Stanley. CityCoins are deployed to help bootstrap city governments with capital meant for delivering value for their community or developing out infrastructure that facilitates the use of crypto within the city. CityCoins are programmable, meaning dApps may be created and secured on them, and ultimately, Bitcoin.

To generate recurring donations to the city, CityCoin twists PoX in such a way that 30% of mining proceeds are donated to a wallet controlled by the city, and the remaining 70% are distributed to those respective CityCoin stackers. A clean dashboard for individually or collectively mining CityCoins using STX or stacking your CityCoins for STX rewards may be found on Syvita Mining. CityCoin has launched two coins so far, MiamiCoin and NYCCoin, due to interest expressed by Mayor Suarez of Miami and Mayor Adams of NYC. Mayor Suarez has already committed to using $5M of the donations generated to make housing in Miami more affordable, and has tossed around the idea of stacking the STX for BTC rewards to distribute to Miami citizens. Other CityCoins are in the pipeline, such as AustinCoin and PhillyCoin.

NFTs

The first Stacks NFT marketplace to really make a splash was the StacksPunks marketplace, which is now more broadly expanded into StacksArt. StacksPunks are a duplicate of the popular CryptoPunks collection on Ethereum, except written in Clarity and secured by Bitcoin. On StacksArt, a user may view their NFTs, list them for sale, explore featured NFT collections, and ultimately buy more.

Following their lead is STXNFT and Byzantion, both of which are competing for dominance. Beyond visual improvements that remain consistent with its minimalistic style, STXNFT offers a plethora of on-chain data for NFT collectors to sort, filter, and analyze. They also feature a blog and newsletter for staying up to date on things such as the Creators Self Service Portal they are building out for seemless creation of projects, and a calendar for viewing upcoming NFT drops. They also plan to become the leading marketplace for Bitcoin NFTs, where collectors may buy, mint, and sell NFTs using native Bitcoin transactions via the Lightning Network.

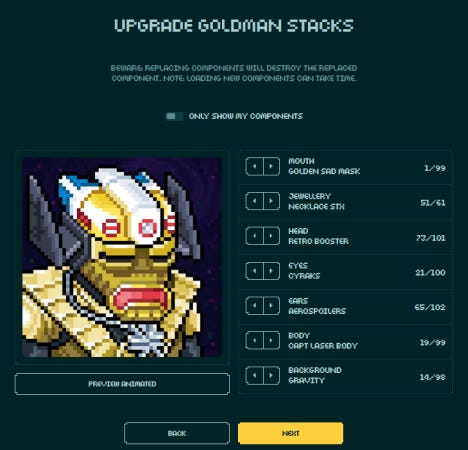

Byzantion commands respect in itself through the aid they offer NFT artists in minting and marketing their artwork and through the aid they offer collectors in using their filtering tool to find bargain NFTs in popular and featured collections. The MegaPont marketplace features the listing, selling, and buying of solely NFTs within the MegaPont collections. The Megapont Ape Club NFT collection is the first collection on Stacks to surpass 1M STX volume traded. The Megapont Robot collection, a collection of ape robots that may be customized in the MegaPont Robot Factory, are not far behind in third place for all-time volume traded.

Interoperability

Satoshibles is an NFT project of comic-styled renditions of Satoshi that minted on the Ethereum blockchain. Upon learning of the existence of the Stacks blockchain, the team prioritized finding a way to create a bridge that holders may utilize to move their Satoshible from Ethereum to Stacks. They succeeded and launched StacksBridge, which allows Satoshible holders a simple way of migrating their Satoshibles onto their desired blockchain by connecting both MetaMask and Hiro Wallet and following the instructions. StacksBridge may soon extend to allowing other NFT projects minted on other blockchains the ability to migrate over to Stacks.

In addition to interoperability with Ethereum and potentially other SC-enabled blockchains, Stacks is also becoming more interoperable with Bitcoin itself. As mentioned previously, Stacks NFTs may be bought, minted, and sold using native Bitcoin transactions via the Lightning Network. Lightning Network decentralized swaps directly to STX are now live as well, thanks to LNSwap.org. LNSwap is a non-custodial exchange that provides a fast and private way of swapping Bitcoin for Stacks, and vice versa. They have also developed an embeddable widget that may be integrated for use on other websites.

DeFi

Aside from LNSwap, many other DeFi protocols are popping up that offer the type of decentralized swapping that is expected out of a protocol attempting to the build the a user owned internet. Ethereum was aided tremendously in its growth because of the creation of decentralized financial (DeFi) applications that facilitate swaps without the need of any intermediaries. Arkadiko and AlexGo are two Stacks DeFi protocols featured in Cohort 1 of the Stacks Accelerator Program. CatamaranSwap allows for P2P trustless exchange between the BTC and STX blockchains using catamaran swaps, or P2P trustless exchange between Stacks digital assets using atomic swaps. Worth mentioning is also StackSwap, another DeFi exchange (DEX) built on Stacks and secured by Bitcoin.

Arkadiko incorporates the creation of vaults for users to deposit their STX for earning stacking yield. They may create loans from these vaults by borrowing USDA, a native Arkadiko stablecoin that attempts to peg itself to the dollar. These loans are paid down over time by the rewards yielded from the STX stacked in a user’s vault. A user may also swap into or out of any native Stacks tokens listed, including xBTC (wrapped BTC on Stacks) and WELSH (first dog memecoin on Stacks). AlexGo offered fixed-rate and fixed-term lending and borrowing, a DEX, yield farming, and a launchpad that boostraps liquidity to emerging project token launches. StackSwap, Arkadiko, and AlexGo all have their own token that serves similar functions to each other for use within each respective DeFi protocol. AlexGo recently announced they have partnered with xVerse mobile wallet so users may soon be able to take DeFi on the go.

GameFi

GameFi will be the next defining moment for the Stacks ecosystem and may spur aggressive Stacks adoption. GameFi is an umbrella term for any sort of decentralized game that incorporates economic incentives for players. The global gaming industry is currently massive, but the traditional model for gaming does very little to promote the user-owned internet.

Pay-to-Play is the standard for gaming companies to monetize their games today, but it offers little opportunity for players to be monetarily rewarded for their time and effort playing a game outside of tournaments, sponsorship opportunities, or streaming revenue for top players. In its most unethical form, these games may exploit players through microtransactions or involve lootboxes that border on breaking gambling laws. Players also usually don’t have the opportunity to truly own their in-game items, leading to an inability to sell those back or trade with other players, and these items could be lost entirely if the game were to disappear.

Soon, Pay-to-Play will be a relic of the past with the introduction of Play-to-Earn games on the decentralized web. Moonray is a sci-fi action RPG being built on Stacks, where transactions regarding the collecting, using, and trading of in-game items are finalized on Bitcoin. This, in addition to the Bitcoin Badger’s Virtual Reality ambitions, may only indicate the beginning for the Bitcoin metaverse. Future generations will learning the user-owned internet built on Bitcoin like millenials learned Microsoft, and in their free time will be playing games with economic incentives secured by Bitcoin, thanks to Stacks.

A GameFi project I am personally biased towards due to my involvement is StacksDegens, an arcade-style Play-to-Earn racing game built on Stacks and secured by Bitcoin that allows Degen holders to record runs and compete in tournaments for rewards. We recently integrated StacksPunks into the game and created four brand new maps. We will soon be incorporating ethical lootboxes, lobbies, a trustless rewards pool, and further NFT customization. All of which will be on-chain, open-source, and verifiable. This includes the randomization function for items earned from lootboxes. You may follow the project on Twitter to learn more here.

The innovation possible is limited only by that of our imagination.

BTB Comments: Big thank you to BowTiedFellow for the huge update. We’re quite impressed to see a lot of anons not only following new projects but actually working on/with them as well (did not know a ton of this stuff in the article!).

As a note, this is an easy way for *you* to get involved in various projects. For readers of the paid stack you know that when we put an asterisk on it… it means we’re not going to follow it as closely (since our goal is to find more computer coins/wifi streams/opportunities for *you*). When we don’t follow something we’re more than happy to hand the baton to someone else to take over (and give them the audience for visibility).

Disclaimer: None of this is to be deemed legal or financial advice of any kind and the information is provided by a group of anonymous cartoon animals with backgrounds in Wall Street and Software.

How deep does this go? The research hours that went in to this article ? Thanks so much for writing this.

@BowTiedFellow thanks for the update! Asking here as others might be interested.

On a technical level, what are some the most painful and challenging aspects working with Clarity and Stacks compared to for other platforms like EVM & Solidity and Polkadot/Solana & Rust?

I'd imagine dev tooling is way less mature?